Introduction

Forex trading requires various technical analysis tools to find trading opportunities. Ignored levels are one such tool that traders use to identify potential support and resistance levels where the market has previously reacted, but the price action has since been ignored.

In this article, we will explain what ignored levels are, how to identify them, and how to trade them for potential profits while also ensuring good readability for the article.

What are ignored levels in forex?

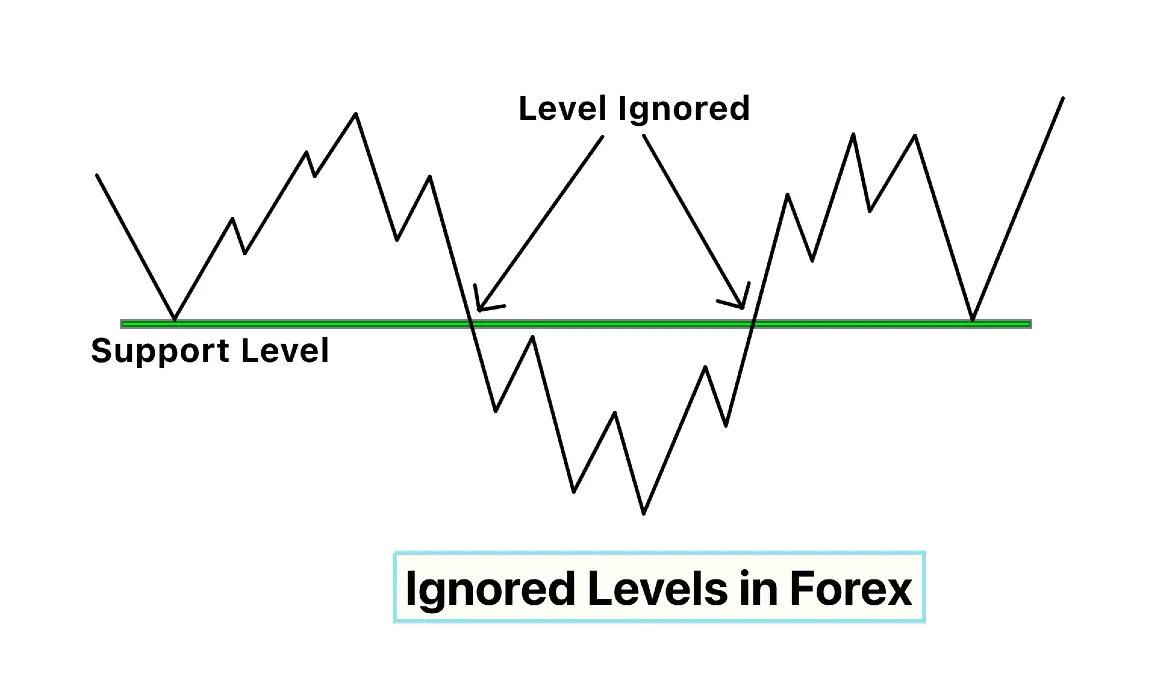

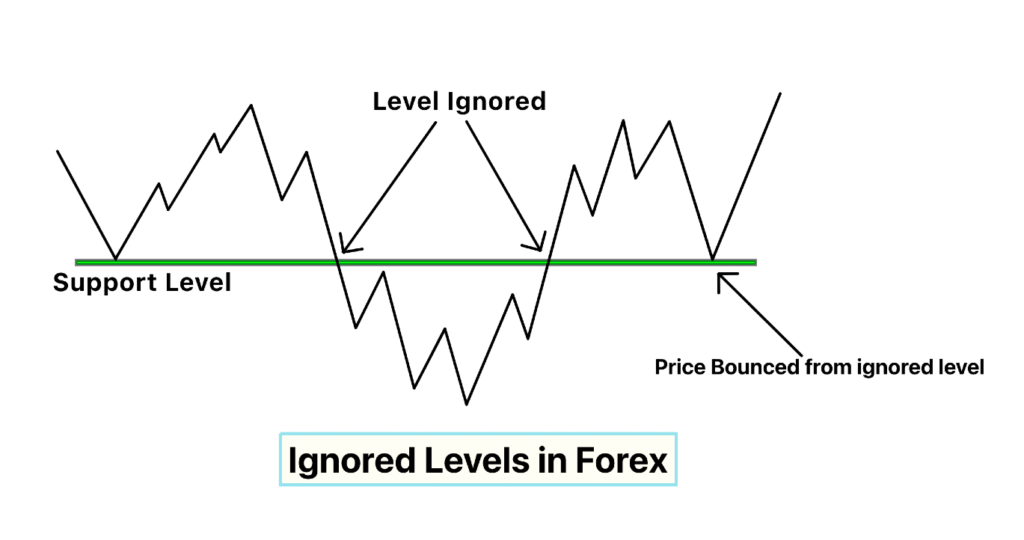

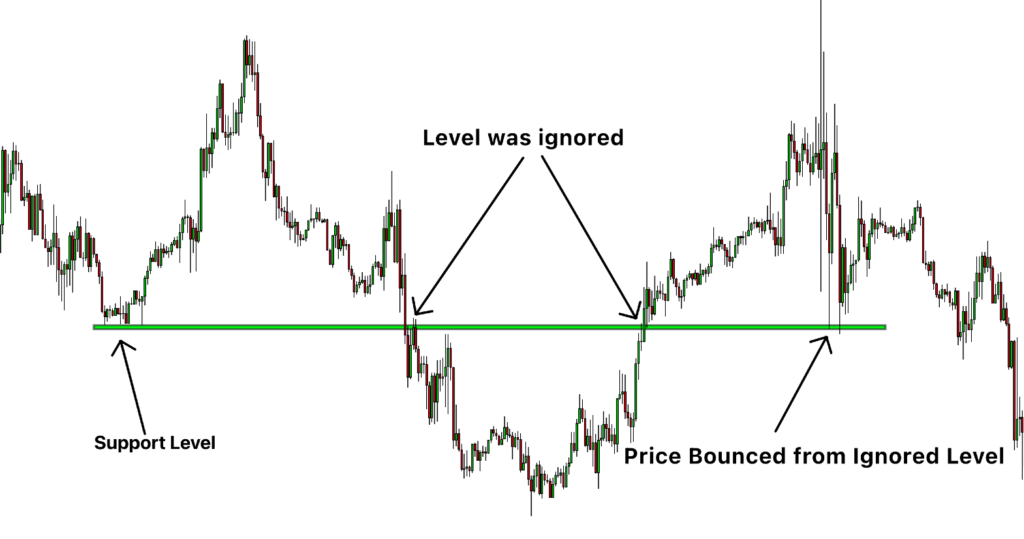

Ignored levels in forex are price levels where the market has reacted before, but the price action has since been ignored during subsequent retests. These levels may appear at support and resistance levels and trend lines. They represent potential reversal points for the market, and traders can use them to identify potential trading opportunities.

How to identify an ignored level?

Traders can identify ignored levels using various technical analysis tools, such as support and resistance levels, trend lines, and candlestick patterns. One way to spot an ignored level is to look for areas on the chart where the market has tested and failed to break through or has broken through but subsequently failed to sustain a move beyond the level.

Ignored levels can act as decision price levels for market makers as they can use them to trigger buying or selling activity. Market makers watch for a break of an ignored level to enter into a new position or to add to an existing position. This can create significant trading volume and momentum in the market that traders can potentially profit from.

How to trade ignored levels?

To trade ignored levels, traders can use a combination of technical analysis tools and risk management techniques to identify potential entry and exit points. One approach is to look for a confluence of technical factors, such as a support or resistance level combined with a candlestick pattern or other technical indicator. This can increase the probability of a successful trade and reduce the risk of a losing trade.

It’s essential to note that when trading ignored levels, traders should be cautious and use risk management techniques such as stop-loss orders to limit potential losses. Ignored levels can be powerful trading signals, but they can also be prone to false breakouts and other trading risks.

Add a confluence of a candlestick pattern

One way to enhance the accuracy of trades based on ignored levels is to use a confluence of technical indicators, such as a candlestick pattern. For example, a bullish engulfing pattern at a key ignored level can signal a potential market reversal and provide a buying opportunity for traders. Similarly, a bearish engulfing pattern at an ignored level can signal a potential market reversal and provide a selling opportunity for traders.

Traders can also look for other forms of confluence to strengthen the trading signal, such as a confluence of an ignored level, a key Fibonacci level, and a trendline.

It’s essential to remember that ignored levels are not a guarantee of a market reversal or breakout. Traders should always use proper risk management techniques, such as placing stop-loss orders and managing their position sizes, to protect themselves from significant losses.

Frequently Asked Questions

Yes, ignored levels can still act as important decision price levels for market makers, and traders should pay attention to these levels in the future.

Traders should look for a confluence of technical analysis tools to confirm the significance of the level, and then wait for price to return to this level in the future. If price bounces off the level, traders can enter a long or short position with a stop loss below or above the level.

Bullish or bearish engulfing patterns, doji, hammer, and shooting star can be useful in identifying potential trading opportunities at ignored levels.

Conclusion

Ignored levels in forex trading can be useful for identifying potential trading opportunities. By identifying these levels and using technical analysis tools, traders can potentially profit from market reversals and breakouts. However, traders should always exercise caution and use proper risk management techniques when trading ignored levels.