Introduction

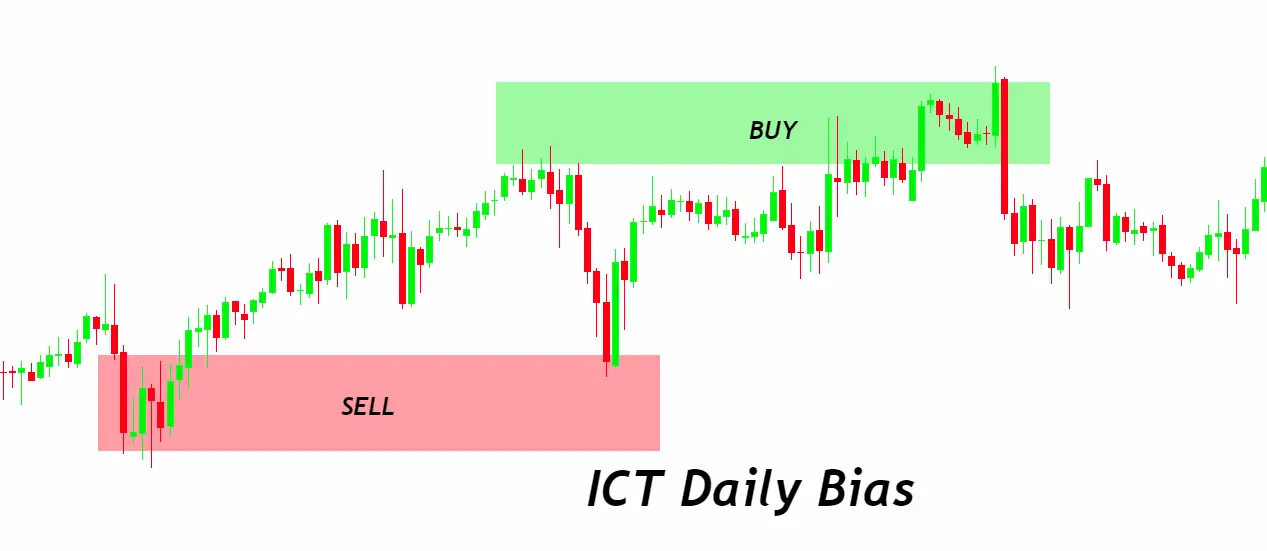

ICT Daily Bias is a concept developed to enhance trading strategies by focusing on daily market trends and liquidity patterns. It centers on the identification of key factors such as sell-side and buy-side liquidity, fair value gaps, order blocks, volume imbalances, and recent highs and lows. These elements collectively help traders understand where the market is likely to move next, by pinpointing areas of significant liquidity that could attract price movement.

In essence, ICT Daily Bias acts as a strategic guide, aiming to make complex trading concepts more accessible and actionable. By analyzing the market through this lens, traders can make more informed decisions about when to enter or exit trades. This methodology leverages the fractal nature of price movements, encouraging traders to look at patterns and behaviors across different timeframes to better predict future market behavior.

This approach not only simplifies the process of trading but also empowers you with the tools to analyze the market in depth. As you incorporate ICT Daily Bias into your trading routine, you will find yourself making choices that are not just based on intuition but are backed by a comprehensive analysis of market dynamics. This can significantly improve your trading strategy, leading to better outcomes and a more confident presence in the markets. Let ICT Daily Bias guide you towards smarter, more informed trading decisions.

Fundamental Concepts of ICT Daily Bias

Delving deeper into ICT Daily Bias requires a solid understanding of its fundamental concepts. These concepts form the bedrock of the strategy, guiding traders through the nuanced landscape of the forex market.

A. Liquidity Analysis

Liquidity analysis stands at the forefront, emphasizing the movement of money within the market. It is pivotal in forecasting market directions.

- Identification of Liquidity Pockets Liquidity pockets are zones where significant buy or sell orders accumulate, acting as magnets for price movement. Traders can identify these areas by analyzing past price actions and market behavior. Recognizing these zones enables traders to anticipate potential price movements towards or away from these pockets, informing strategies for entry and exit points.

- Market Movement Dynamics Understanding how the market transitions between these liquidity pockets is crucial. The market moves in search of liquidity, navigating from one pocket to another, guided by the collective actions of institutional traders and banks. This understanding helps traders grasp the underlying currents of market movements, enabling them to predict with greater accuracy where the price is likely to head next.

B. Fractality of Price Movement

The concept of fractality highlights the repetitive nature of market movements across different timeframes, revealing patterns that traders can exploit.

- Mirror Patterns Between Higher and Lower Timeframes The fractal nature of the market means that patterns, such as trends and reversals, observed on larger timeframes like weekly charts, often repeat on smaller timeframes, including daily charts. This repetition offers traders a unique advantage, as it allows for the prediction of market movements with a degree of confidence, based on the behavior observed on higher timeframes.

- Price Disrespect on Lower Timeframes While larger timeframes provide a clearer, more reliable view of market trends, smaller timeframes are subject to more volatility and ‘noise.’ This can lead to price movements that seem to disregard previously identified patterns and trends. Successful traders understand this discrepancy and adjust their strategies to mitigate the risks associated with the unpredictability of lower timeframes.

C. Utilizing Weekly Bias for Daily Analysis

Incorporating a longer-term perspective into daily trading decisions enriches the strategy by providing context and direction.

- Importance of Weekly Market Trend The weekly market trend is a powerful indicator of the market’s overall direction. A bullish or bearish trend on the weekly chart can set the stage for daily trading, offering a macroscopic view that should guide daily trading decisions. Understanding the weekly trend helps traders align their daily trades with the broader market movement, increasing the chances of success.

- Focusing on Daily Opportunities Aligned with Weekly Trends Once the weekly trend is identified, traders should look for trading opportunities on the daily chart that align with this trend. For example, in a weekly bullish trend, traders would seek opportunities to buy on daily dips, targeting areas of liquidity that suggest upward continuation. This alignment ensures that daily trading strategies are in harmony with the larger market dynamics, leveraging the momentum of the weekly trend for more effective trading outcomes.

Developing ICT Daily Bias: Step-by-Step Approach

Creating an effective ICT Daily Bias involves a methodical approach that can significantly enhance your trading strategy. This step-by-step guide simplifies the process, making it accessible for traders at all levels.

A. Step 1: D1 Timeframe Analysis

The first step centers around the daily (D1) chart, a favorite among institutional traders for its balance between detail and broader market perspective.

- Importance of the Daily Chart for Institutional Traders Institutional traders prefer the daily chart because it filters out the ‘noise’ of shorter timeframes while providing insights into market trends. This chart offers a clear view of price movements, helping traders make more informed decisions.

- Marking Recent Swing Highs and Lows Start by identifying the most recent swing highs and lows on the daily chart. These points are crucial as they offer hints about potential future movements. Marking these swings at the beginning of the week sets the stage for anticipating market direction.

B. Step 2: Identifying Drawn-on Liquidity

Next, focus on understanding liquidity dynamics and how they affect market direction.

- Algorithm Activity and Liquidity Direction Analyze recent market activity to determine if it’s leaning towards buying or selling. This involves understanding how algorithms and institutional orders are influencing market liquidity.

- Anticipating the Next Drawn-on Liquidity Based on recent activity, try to predict where the next significant movement of liquidity will be. For instance, if the market has recently targeted sell-side liquidity, it might next move towards buy-side liquidity, and vice versa.

C. Step 3: Premium and Discount Zones

This step involves analyzing the market’s position in relation to its average price, to decide on a trading bias.

- Determining the Bias Based on Price Zones If the price is in a premium zone (above the perceived fair value), consider a bearish bias, suggesting prices might drop. Conversely, if in a discount zone (below fair value), a bullish bias may be more appropriate, indicating potential price increases.

D. Step 4: Fair Value Gaps and Order Blocks

Finally, reinforce your analysis with additional concepts to solidify your daily bias.

- Substantiating Analysis with Additional Concepts Look for fair value gaps and order blocks that might support your earlier findings. These elements can confirm your bias, offering a stronger foundation for your trading decisions. Fair value gaps indicate areas where the price might rapidly move to ‘fill’ the gap, while order blocks suggest areas of significant buying or selling interest in the past that may influence future price movements.

ICT Forex Essentials to Trading the Daily Bias

Trading with the ICT Daily Bias method involves understanding several key concepts that are foundational to navigating the forex market effectively. These essentials provide traders with the tools needed to analyze market conditions, anticipate movements, and make informed decisions. Let’s delve into each of these components:

A. Liquidity

Liquidity refers to the availability of buy and sell orders in the market, influencing how easily trades can be executed without significantly affecting the market price. High liquidity areas attract price action, serving as magnets for future movements.

- Key Point: Identifying areas of high liquidity helps traders predict where the market is likely to move, enabling them to position their trades around these zones for better entry and exit points.

B. Premium and Discount Zones

The concepts of premium and discount zones help traders assess the market’s valuation at any given time, providing clues on whether it’s overvalued (premium) or undervalued (discount).

- Key Point: If the price is in a premium zone, it might be time to consider selling, as the market could be overbought. Conversely, a price in the discount zone suggests the market may be oversold, presenting a potential buying opportunity.

C. Fair Value Gaps

Fair value gaps occur when there’s a significant price move within a short period, leaving a ‘gap’ that the market may later seek to fill. These gaps can act as targets for future price movements.

- Key Point: Understanding fair value gaps enables traders to anticipate areas where the price might return, offering strategic points for trade entries or exits based on the principle that price tends to fill these gaps.

D. Order Blocks

Order blocks are areas on the chart where significant buy or sell orders are placed by institutional traders or banks. These zones can influence the market direction when the price returns to these levels.

- Key Point: Identifying order blocks provides insights into potential reversal points or areas of strong support and resistance, guiding traders on where to place trades in alignment with institutional market movements.

E. Breaker Block

A breaker block is a concept that identifies a zone where the market structure has been ‘broken,’ indicating a potential reversal or continuation of the trend. These blocks are strategic areas for entering or exiting trades.

- Key Point: Recognizing breaker blocks can help traders find high-probability trade setups, as these areas often signify a shift in market sentiment or momentum, offering clues on future price movements.

Conclusion

In conclusion, the ICT Daily Bias approach offers traders a comprehensive framework for understanding and navigating the complexities of the forex market. By focusing on key concepts such as liquidity, premium and discount zones, fair value gaps, order blocks, and breaker blocks, traders can gain insights into market dynamics, enabling them to make more informed decisions. The step-by-step methodology for developing a daily bias, coupled with a deep dive into the essentials of forex trading, equips traders with the tools needed to identify potential trading opportunities and execute trades with greater confidence. Embracing these principles and incorporating them into your trading strategy can significantly enhance your ability to recognize and capitalize on market trends, ultimately leading to improved trading outcomes. Whether you’re a novice looking to understand the basics or an experienced trader seeking to refine your approach, the ICT Daily Bias and its foundational concepts offer valuable guidance for navigating the forex market effectively.