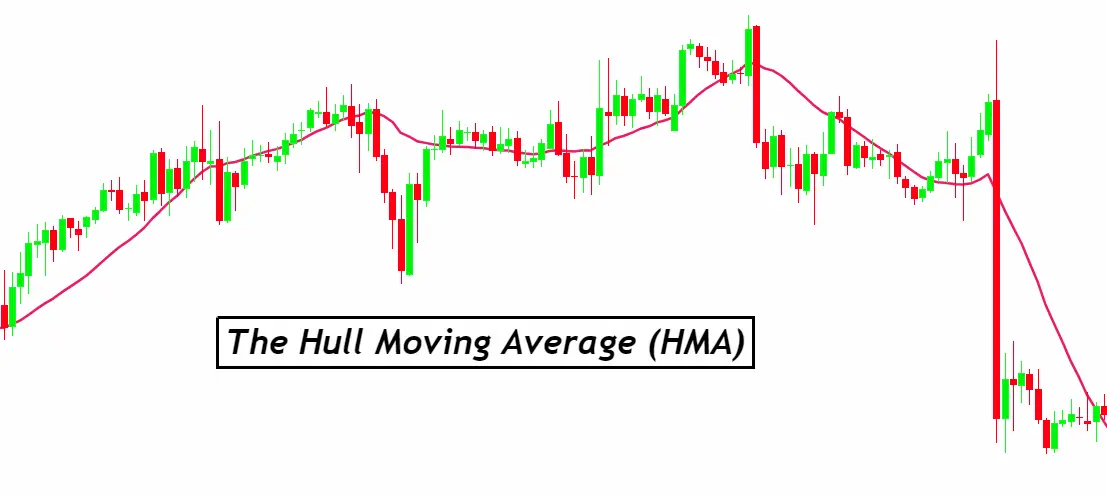

The Hull Moving Average (HMA) is a highly efficient financial indicator developed by Alan Hull. It aims to reduce the lag associated with traditional moving averages, providing smoother and more accurate signals for traders. The unique calculation method of HMA combines the weighted moving average’s speed and smoothness, significantly enhancing its responsiveness to market price changes. This feature makes HMA particularly useful for identifying market trends more quickly and accurately than many other moving averages, thus being a favored tool among Forex traders for its efficiency in trend analysis and decision-making processes.

Benefits of Using HMA

Using the Hull Moving Average (HMA) offers several benefits for traders:

- Faster Response to Price Changes: HMA updates more quickly to recent price movements, providing timely entry and exit signals.

- Reduced Lag: Minimizes the inherent delay found in traditional moving averages, allowing for more precise trading decisions.

- Smoothed Price Data: Effectively filters out market noise, presenting a clearer picture of the trend.

- Improved Trend Identification: HMA’s smoother line helps in identifying trend reversals and continuations with greater accuracy.

- Versatility: Suitable for various trading instruments and time frames, making it adaptable for different trading strategies.

- Ease of Use: Simple to interpret, making it accessible for traders at all levels of experience.

How HMA Works

The Hull Moving Average (HMA) works by combining the advantages of weighted moving averages with a unique mathematical formula to reduce lag and increase responsiveness. Here’s a simplified breakdown of its operation:

- Calculate Weighted Moving Average (WMA): First, HMA computes the WMA for a given period, say ( n ). This step prioritizes more recent prices.

- Determine WMA of Half-Length: Next, it calculates the WMA for half the initial period, ( n/2 ), to increase responsiveness.

- Double the Half-Length WMA: The result from step 2 is then doubled to emphasize recent price movements.

- Subtract Full-Length WMA: From the doubled half-length WMA, the initial full-length WMA (from step 1) is subtracted to correct the lag.

- Compute Final HMA: The result is then used to calculate the WMA of the square root of the initial period length, producing the final HMA value.

This process ensures that the HMA is both smooth and responsive, making it a preferred tool for traders looking to capture trends early without the noise typically associated with other moving averages.

Applying HMA in Trading Strategies

Incorporating the Hull Moving Average (HMA) into trading strategies can significantly enhance decision-making processes. Here’s how traders can apply HMA:

Trend Identification

- Bullish Signal: When the HMA line turns upward and crosses above the price, it may indicate a potential upward trend, suggesting a buying opportunity.

- Bearish Signal: Conversely, if the HMA line turns downward and crosses below the price, it might signal a downward trend, indicating a possible selling point.

Signal Confirmation

- Use HMA in conjunction with other indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) for confirming trade signals. A trend indicated by HMA should align with signals from these other indicators for higher trade reliability.

Stop-Loss and Take-Profit Points

- Set stop-loss orders just below recent lows in a bullish trend or above recent highs in a bearish trend as indicated by the HMA.

- Take-profit points can be set where the HMA starts to flatten or reverse, indicating a potential end to the trend.

Crossovers

- Implement a two-HMA strategy where one HMA is set with a shorter period and another with a longer period. A crossover of the shorter period HMA above the longer period HMA could be used as a buy signal, while a crossover below could signal a sell.

Filtering

- Use HMA to filter out noise in ranging markets. Trades should only be considered when the HMA slope is significant, indicating a strong trend.

By applying these strategies, traders can leverage the HMA’s responsiveness and accuracy to improve their trading performance. However, it’s crucial to backtest any strategy with HMA on historical data to ensure its effectiveness in different market conditions.

HMA vs. Other Moving Averages

The Hull Moving Average (HMA) stands out from other moving averages due to its unique calculation, offering distinct advantages:

HMA vs. Simple Moving Average (SMA)

- Speed: HMA provides faster signals than SMA due to its advanced formula, which reduces lag.

- Responsiveness: HMA adjusts more quickly to recent price changes, whereas SMA gives equal weight to all values, leading to a slower response.

- Trend Clarity: HMA’s smoother line offers a clearer view of the trend, while SMA can be more susceptible to price noise.

HMA vs. Exponential Moving Average (EMA)

- Lag Reduction: Although EMA also emphasizes recent prices to reduce lag, HMA’s methodology makes it even more responsive.

- Smoothness: HMA typically presents a smoother curve compared to EMA, which can sometimes be more erratic due to its sensitivity to recent price movements.

HMA vs. Weighted Moving Average (WMA)

- Complexity and Efficiency: HMA uses WMA in its calculation but applies a square root length and a unique weighting scheme, providing a more balanced and efficient indicator.

- Signal Quality: HMA tends to produce higher quality signals with less noise compared to WMA, which can be overly sensitive to recent price changes.

In summary, HMA’s advanced calculation method allows it to outperform traditional moving averages like SMA, EMA, and WMA in terms of responsiveness, lag reduction, and trend clarity, making it a valuable tool for traders seeking to enhance their market analysis and decision-making processes.

Tips for Optimizing HMA Use

To optimize the use of the Hull Moving Average (HMA) in trading, consider the following tips:

1. Choose the Right Period Length

- Experiment with different period lengths for HMA to find the one that best suits your trading style and the market conditions you’re trading in.

2. Combine with Other Indicators

- Use HMA alongside other technical indicators like MACD, RSI, or Bollinger Bands to confirm signals and reduce false positives.

3. Look for Confluence

- Seek areas where HMA signals coincide with other technical patterns such as support/resistance levels, Fibonacci retracements, or chart patterns for stronger trade setups.

4. Apply in Suitable Markets

- HMA works best in trending markets. Be cautious in sideways markets where moving averages can produce many false signals.

5. Use Multiple Time Frames

- Analyze HMA on multiple time frames to get a broader view of the market trend. For instance, a signal on a longer time frame can confirm the trend, while a shorter time frame provides entry points.

6. Backtest Strategies

- Before applying any HMA-based strategy in live trading, backtest it on historical data to understand its effectiveness and adjust parameters accordingly.

7. Manage Risk

- Always combine HMA strategies with sound risk management practices, such as setting stop-loss orders and only risking a small percentage of your account on each trade.

8. Stay Updated

- Keep abreast of market news and events that can cause volatility, as these can affect the performance of technical indicators like HMA.

By following these tips, traders can more effectively leverage the Hull Moving Average’s strengths, improving their trading performance while managing risk.

Common Pitfalls to Avoid

When using the Hull Moving Average (HMA) in trading, it’s essential to be aware of common pitfalls to avoid:

1. Overreliance on HMA

- Don’t rely solely on HMA for trading decisions. Combine it with other analysis tools and indicators for a more comprehensive trading strategy.

2. Ignoring Market Context

- Be mindful of the overall market context. HMA, like all indicators, may not perform well in all market conditions, particularly in highly volatile or sideways markets.

3. Misinterpreting Signals

- Avoid jumping on every HMA signal without confirmation. Some movements might be false signals or minor corrections within a larger trend.

4. Neglecting Risk Management

- Failing to apply proper risk management practices, such as setting stop-losses or managing trade sizes, can lead to significant losses, even with accurate signals.

5. Impatience and Overtrading

- HMA might lead to early entries if not used patiently. Wait for clear, confirmed signals before entering trades to avoid overtrading.

6. Lack of Backtesting

- Not backtesting HMA strategies on historical data can result in using a strategy that doesn’t suit the current market conditions or your trading style.

7. Chasing the Perfect Setup

- Seeking the perfect trade setup can lead to missed opportunities. No indicator, including HMA, provides perfect signals all the time.

By being aware of these pitfalls and taking steps to avoid them, traders can more effectively use the Hull Moving Average in their trading strategies, improving their chances of success in the forex market.

Conclusion

The Hull Moving Average (HMA) stands out as a robust tool in the arsenal of Forex traders, known for its swift response to price changes and reduced lag compared to traditional moving averages. Its unique calculation method offers a smoother, more accurate representation of market trends, making it invaluable for identifying trading opportunities with greater precision.

To harness the full potential of HMA, it’s crucial to integrate it into a comprehensive trading strategy, complemented by other technical indicators and thorough market analysis. By doing so, traders can enhance their decision-making process, increasing their chances of successful trades.

However, it’s essential to remain mindful of the common pitfalls associated with its use, such as overreliance on the indicator or neglecting the importance of risk management. By avoiding these traps and adhering to best practices, traders can optimize their use of HMA, making it a powerful ally in navigating the complexities of the Forex market.

In conclusion, whether you’re a seasoned trader or just starting out, the Hull Moving Average can significantly contribute to your trading strategy, providing you with a clearer view of market trends and helping you to execute more informed trades.