Moving Averages (MAs) serve as one of the cornerstone tools in forex trading, providing a streamlined view of price trends by smoothing out price data over a specified period. This guide breaks down the concept, making it easy for both novice and experienced traders to enhance their market analysis and decision-making strategies.

What is a Moving Average?

- Simplifies Price Data: A Moving Average calculates the average price of a currency pair over a specific number of periods, offering a clear view of the trend direction.

- Indicator of Trends: It helps identify the direction of the market trend, aiding traders in making informed decisions.

How Do Traders Use Moving Averages?

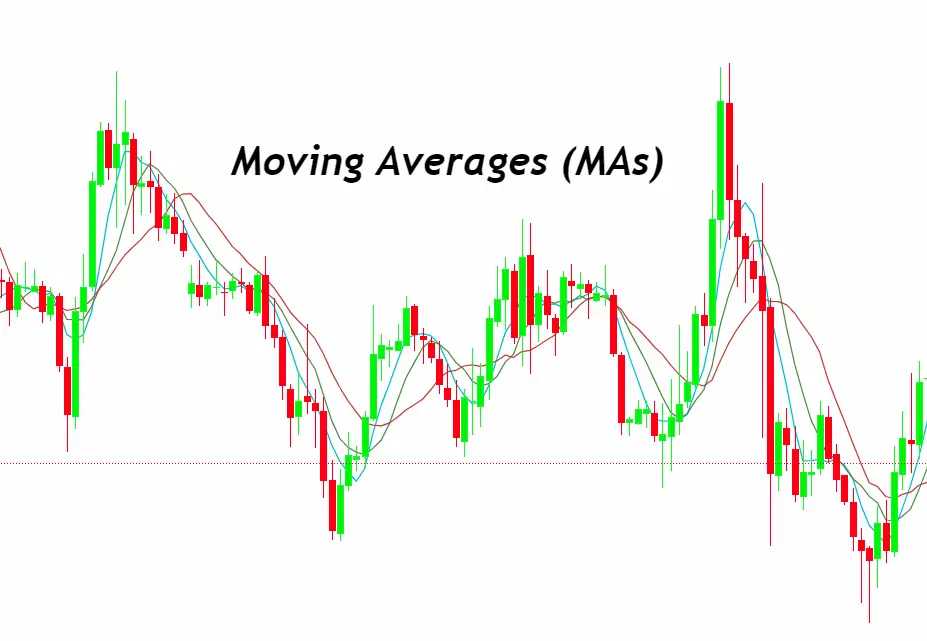

- Trend Identification: By plotting MAs on charts, traders can visually discern the market trend. An upward trending MA suggests a bullish market, while a downward MA indicates a bearish market.

- Support and Resistance Levels: MAs can act as dynamic support and resistance levels. Prices often bounce off these MA lines, providing key entry and exit points.

- Signal for Entry and Exit: Traders often look for prices to cross over the MA as a signal to enter or exit trades, capitalizing on potential trend reversals.

By understanding and applying Moving Averages, forex traders can refine their market analysis, leading to more strategic trading decisions and potentially enhanced trading performance.

Types of Moving Averages

In the realm of forex trading, Moving Averages (MAs) come in various forms, each with unique characteristics and applications. Here, we delve into the two most prevalent types: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA), providing traders with insights to choose the right MA for their strategy.

Simple Moving Average (SMA)

- Definition: The SMA calculates the average currency pair price over a specific number of periods, giving equal weight to each price point.

- Calculation: Add up the closing prices over the set periods and divide by the number of periods.

- Usage: Ideal for identifying long-term trends and smoothing out price data.

Exponential Moving Average (EMA)

- Definition: The EMA places more emphasis on recent prices, making it more responsive to new information and price changes.

- Calculation: Besides the simple average, EMA incorporates a multiplier for weighting recent price data more heavily.

- Advantages: Due to its sensitivity, EMA is preferable for short-term trading and for those looking to catch early trend changes.

By understanding the nuances between SMA and EMA, traders can tailor their approach to align with their trading style and objectives, whether they’re focused on long-term trend following or short-term movements.

Setting Up Your Moving Average

Setting up a Moving Average (MA) on your trading platform is a straightforward process that can significantly enhance your market analysis. Follow these steps to integrate MA into your trading strategy, whether you prefer the Simple Moving Average (SMA) or the Exponential Moving Average (EMA).

Step-by-Step Guide

- Select Your Chart: Open the chart of the currency pair you wish to trade.

- Find the MA Indicator: Navigate to the indicators list on your trading platform and select either SMA or EMA, depending on your preference.

- Configure the Period: Input the number of periods for your MA. Common periods include 10, 20, 50, 100, and 200 days, but choose based on your trading strategy.

- Choose the Price Type: Most MAs are calculated using closing prices, but you can also select open, high, or low prices.

- Customize the Appearance: Adjust the color, thickness, and line type of the MA to make it easily identifiable on your chart.

- Apply and Analyze: Once set up, analyze the MA in relation to the price action to identify trends, support, and resistance levels.

Tips for Selecting the Right Time Period

- Short-Term Trading: If you’re a day trader or scalper, consider shorter periods like 10 or 20 to capture quick market movements.

- Long-Term Trading: For swing or position traders, longer periods such as 50, 100, or 200 days can provide insight into broader market trends.

- Experiment and Adjust: Start with standard periods, then adjust based on your observations and the market’s response to those settings.

Incorporating MAs into your trading setup empowers you to make more informed decisions by providing a clearer view of market trends and potential turning points.

Strategies for Trading with Moving Averages

Moving Averages (MAs) are versatile tools that can enhance trading strategies by providing clear signals for entry and exit points. Here are some effective strategies that utilize MAs to identify potential trading opportunities in the forex market.

Trend-Following Strategies

- Buy Signal: Consider buying when the price of a currency pair moves above the MA, indicating an uptrend. This is a signal that bullish momentum is increasing.

- Sell Signal: Consider selling or shorting when the price falls below the MA, suggesting a downtrend and increasing bearish momentum.

Crossover Strategies

- Golden Cross: This bullish signal occurs when a shorter-term MA (like the 50-day) crosses above a longer-term MA (like the 200-day), indicating potential upward momentum and a buying opportunity.

- Death Cross: Conversely, a death cross is a bearish signal where a shorter-term MA crosses below a longer-term MA, suggesting downward momentum and a potential selling or shorting opportunity.

Tips and Best Practices

- Confirmation: Always look for additional confirmation from other indicators or chart patterns to validate MA signals and reduce false positives.

- MA Settings: Experiment with different MA settings and types (SMA vs. EMA) to find the best fit for your trading style and the market conditions.

- Market Context: Consider the overall market context and economic indicators. MAs can provide misleading signals in highly volatile or sideways markets.

By incorporating these strategies into your trading plan, MAs can become a powerful tool in your arsenal, helping you to navigate the complexities of the forex market with greater confidence and precision.

Tips and Best Practices for Trading with Moving Averages

Trading with Moving Averages (MAs) can significantly improve your market analysis and decision-making process. Here are some key tips and best practices to help you optimize your use of MAs in forex trading:

1. Combine MAs with Other Indicators

- Don’t rely solely on MAs for trading decisions. Combine them with other indicators like RSI, MACD, or Bollinger Bands for a more comprehensive analysis.

2. Use MAs for Trend Confirmation

- Use MAs to confirm trends identified by other analysis methods. If an MA aligns with your other analysis, it can add confidence to your trades.

3. Be Aware of Lag

- Remember that MAs are lagging indicators. They reflect past price action, so always consider the inherent delay when making trading decisions.

4. Customize MA Settings

- Customize the periods based on your trading style. Short-term traders might prefer shorter periods, while long-term traders may opt for longer ones.

5. Watch for False Signals

- In volatile or sideways markets, MAs can produce false signals. Always wait for additional confirmation before acting on MA signals.

6. Use Multiple MAs for Different Perspectives

- Using multiple MAs with different time frames can provide insights into both short-term and long-term trends.

7. Practice on a Demo Account

- Before applying MA strategies in live trading, practice on a demo account to understand how they work in different market conditions.

8. Keep It Simple

- While it’s tempting to use many indicators, simplicity often leads to better clarity and decision-making in trading.

By following these tips and best practices, you can more effectively leverage Moving Averages in your forex trading strategy, helping to identify trends, make informed decisions, and manage risk more effectively.

Conclusion

Incorporating Moving Averages (MAs) into your forex trading strategy offers a systematic approach to understanding market trends and making informed decisions. By smoothing out price data, MAs provide a clearer picture of the market direction, helping traders to identify potential entry and exit points.

Remember, while MAs are powerful tools, they work best when combined with other indicators and analysis techniques. The key to successful trading lies in a balanced strategy that considers multiple data points and market signals. Practice and continuous learning are essential, as the forex market’s dynamics are ever-changing.

We encourage you to experiment with different types of MAs and settings to find what works best for your trading style and objectives. And always be mindful of the market context and economic indicators to enhance your trading decisions.

Moving Averages, with their simplicity and effectiveness, can be a valuable addition to your trading toolkit. By mastering their use and integrating them with a comprehensive trading plan, you can navigate the forex market with greater confidence and precision.